Monday, December 28, 2009

The Definitive Timeline

Wow! The definitive time line of Climategate. There are a lot (and apparently increasing number) of reputable skeptics to whom we will owe a great deal in the future.

Wednesday, December 9, 2009

No Need to Read

I'm posting this commentary on climate statistics mostly for my own future reference. Of course you're welcome to take a peak if you wish. As a former student of atmospherics (for the purposes of radio communications), this is some pretty fascinating information and consistent with what I learned way back when: the climate is a vastly, vastly, vastly (vast to the 3rd power?) complex mechanism.

Quote of the Day

From one of my favorites, Jonah Goldberg,who can regularly be found at National Review (http://corner.nationalreview.com/). He's commenting on a recent article by Thomas Friedman of the New York Times.

"Last, at the bottom of Friedman's column it says "Maureen Dowd is off today." Question: Why don't they put that disclaimer under Maureen Dowd's column where it belongs?"

"Last, at the bottom of Friedman's column it says "Maureen Dowd is off today." Question: Why don't they put that disclaimer under Maureen Dowd's column where it belongs?"

Tuesday, December 1, 2009

Corporatism is not Capitalism

There is a natural tendency for any organization to seek to tilt the playing field to its own advantage. Businesses have this tendency like any other entity and I fear that we are now in the throws of full grown Corporatism. (In the old days this was called Mercantilism.) This statement by Donald Trump is an excellent example. He wants the government to force (not encourage, but force) banks to lend money where they would rather not. That, my friends, is not free markets in action nor is it Capitalism. That is Corporatism where one party (Trump) is trying to use an external player (the government) to provide him with his preferred working environment.

I was never a great Trump fan and now I know why.

I was never a great Trump fan and now I know why.

Monday, November 30, 2009

As the Brits say, "Brilliant!"

I contend that stakeholders in General Motors and Chrysler will rue the day they got in bed with the U.S. government. One of the best business moves of my lifetime was Ford Motor Company's sidestep away from direct government aid at the end of 2008. Here is a cautionary tale from British Leyland in the 1970s for anyone who thinks government ownership of a major industrial enterprise is a good thing.

Wednesday, November 11, 2009

The Old Term Was Crowding Out

It the bad old days (pre-Reagan and early Reagan), a common phrase in economics was "crowding out" and that government borrowing reduced the capital in the system available for private investment. It's probably happening again.

Monday, November 9, 2009

The Decline of the IPO

I saw on CNBC this morning that the Initial Public Offering is in a secular (long-term) decline in the United States. You may think this is a recent event, tracking to Sarbanes-Oxley or the 2008 crash ... and you'd be wrong. It goes back to around 1997.

In general, this is a bad thing. An open market is a very efficient allocator of capital. There are many more transaction costs in raising money through private equity than in the open market.

So, if it's a bad thing, why is it happening and can anything be done? Here's one idea and I'll try to stay on this topic for a bit to see how it develops.

In general, this is a bad thing. An open market is a very efficient allocator of capital. There are many more transaction costs in raising money through private equity than in the open market.

So, if it's a bad thing, why is it happening and can anything be done? Here's one idea and I'll try to stay on this topic for a bit to see how it develops.

Monday, November 2, 2009

To Good to Pass

This must be the quote of the month - referring to Sunday's Minnesota 38 Green Bay 26 result.

"On Sunday, Brett Favre got what really wanted: revenge against his wicked ex-employer, the Green Bay Packers. If you were a Packer fan at Lambeau, it had to smart. Sort of like watching your high school girlfriend show up to your 25th reunion—with George Clooney."

"On Sunday, Brett Favre got what really wanted: revenge against his wicked ex-employer, the Green Bay Packers. If you were a Packer fan at Lambeau, it had to smart. Sort of like watching your high school girlfriend show up to your 25th reunion—with George Clooney."

Saturday, October 31, 2009

A Good, Quick Primer

I am fascinated by monetary policy and central banking and have been since graduate school. My technical analysis skills have weakened over the years and I often struggle to explain some basic things to dinner companions who end up looking at me as if I have three eyes. Bruce Bartlett has written a pretty good, quick read on how failings in monetary policy (made worse by failings in fiscal policy) caused (that's right, caused) the Great Depression. Not capitalist greed, not political avarice, failed monetary policy.

Seriousy, Stop Worrying about Hyperinflation

The title says it all. This is a pretty good summary of the forces that will restrain the government from inflating away the debt. Of course, how we pay for it is a different matter.

Thursday, October 22, 2009

Thursday, October 15, 2009

Will You Know It When You See It?

This is, by definition, fascism in action. If you think not then I ask that you read up on the economic policies of Benito Mussolini.

Monday, October 12, 2009

Wednesday, October 7, 2009

Gramm-Rudman - zzzzzzzzzzzzzz

One of the better ideas I've seen in a while and here's the money quote.

"By setting annual deficit ceilings as a share of the economy, Congress would have more incentive to adopt pro-growth economic policies and avoid anti-growth policies such as increasing tax rates on work effort and investment or raising taxes on energy."

Oh, and by linking this, I am officially boring.

"By setting annual deficit ceilings as a share of the economy, Congress would have more incentive to adopt pro-growth economic policies and avoid anti-growth policies such as increasing tax rates on work effort and investment or raising taxes on energy."

Oh, and by linking this, I am officially boring.

Tuesday, October 6, 2009

Australia Hops

Australia's central bank has raised its lending rate by 25 basis points. I read a very interesting economic commentary (no link, unfortunately) that speculated that the best way a central bank can halt an economic decline is to publicly declare a floor on interest rates and hold to it. A central bank that continually lowers rates also continually sets an expectation that an economy is bad and getting worse. The thinking was that setting a rate floor creates a psychological floor as well. Is it true? I don't know but Australia may be giving us a clue.

Friday, October 2, 2009

Thursday, October 1, 2009

Cannot and Does Not

Here's an interesting piece of research on Keynesian spending and whether or not it actually produces results. Does government spending for the purpose of raising gross domestic product actually work? The conclusion of the authors is that it does not.

Wednesday, September 30, 2009

Monday, September 28, 2009

Will the Stimulus Create Jobs?

According to an article by Veronique de Rugy and Garett Jones, not only will it not create jobs, it cannot create jobs.

Monday, September 21, 2009

The Real Estate Recovery

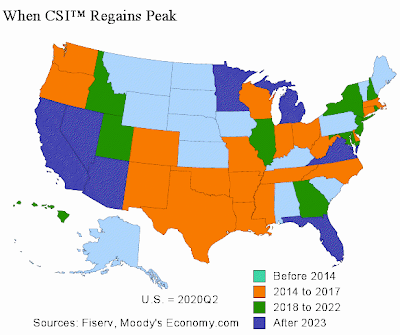

Here is a very interesting graphic predicting the timing of the recovery of real estate values. I remember the decline of the late 1980s and early 90s clearly - when then Savings and Loan debacle occurred. The decline that began in 2006 looks like it will dwarf the S&L-induced decline. In the case of the S&L decline, real estate had regained its highs by the late 90s. It may be decades before some parts of the country recover this time around.

Sunday, September 20, 2009

A Lament for My Children

A few months ago, my company had a retirement consultant give a lunch-time presentation on 401k accounts. He was very knowledgable and well spoken so it was a worthwhile discussion. At one point he was discussing national fiscal habits and asked the group "who do you think will be paying for the deficits and the stimulus package?" Unprompted, I answered, "My children." This cartoon from the Wall Street Journal says it better than I can.

Thursday, September 17, 2009

Right on Time

I'll repeat an observation I made earlier that the market rebound in March of 2009 would signal economic growth six months later. Now it's September and here it is - in a fashion that no one can deny. Now the debate will be V-Shape, W-Shaped, or L-Shaped recovery.

Tuesday, September 15, 2009

Not What They Had In Mind

Want to know more about the effects of unintended consequences? Read this.

Thursday, September 10, 2009

Why is ERP Still So Hard?

Because you're changing the wings of the plane while it's still in the air. Check this out for a good discussion on the topic.

The key information I gleaned is this: the average SAP implementation costs $17 million, Oracle ERP is $12 million, Microsoft Dynamics is $2.6 million and other (Tier 2) systems like JD Edwards or ERP LN come in around $3.5 million.

I'm betting a lot of SAP and Oracle ERP customers wonder what they get for their premium.

The key information I gleaned is this: the average SAP implementation costs $17 million, Oracle ERP is $12 million, Microsoft Dynamics is $2.6 million and other (Tier 2) systems like JD Edwards or ERP LN come in around $3.5 million.

I'm betting a lot of SAP and Oracle ERP customers wonder what they get for their premium.

Wednesday, September 2, 2009

Goverment Spending Cannot Create Jobs

I've long believe that John Maynard Keynes was wrong and that government spending during an economic downturn has no net effect on economic performance. I studied Keynes in graduate school. I could regurgitate his ideas well enough to get a passing grade but they never really made sense to me. This link has a good (non technical) explanation why.

The money quote, "Keynesian economists counter that redistribution can increase demand if the money is transferred from savers to spenders. Yet this “idle savings” theory assumes that savings fall out of the economy, which clearly is not the case. Nearly all individuals and businesses invest their savings or put it in banks (which in turn invest it or lend it out) — so the money is still being spent somewhere in the economy. Even in this recession, with tightened lending standards, banks are performing their traditional role of intermediating between those who have savings and those who need to borrow. They are not building extensive basement vaults to hoard cash."

The money quote, "Keynesian economists counter that redistribution can increase demand if the money is transferred from savers to spenders. Yet this “idle savings” theory assumes that savings fall out of the economy, which clearly is not the case. Nearly all individuals and businesses invest their savings or put it in banks (which in turn invest it or lend it out) — so the money is still being spent somewhere in the economy. Even in this recession, with tightened lending standards, banks are performing their traditional role of intermediating between those who have savings and those who need to borrow. They are not building extensive basement vaults to hoard cash."

Tuesday, September 1, 2009

A September Marker

Conventional wisdom says that the stock market leads the economy, usually by about six months. In March of 2009, the Dow hit what I hope is the bottom for the year. The very good performance since then, and the six month lag of the real economy, means the economy should start performing measurably better ... right ... about ... now!

Monday, August 31, 2009

Does the Fed Do It's Job?

Milton Friedman was my monetarist hero. I still have his seminal, Nobel winning work, A Monetary History of the United States, somewhere in my book collection. (And, I will admit that I did not read it cover-to-cover but I have skimmed through it.)

The late great Milton would agree with the contention of this commentator that the Federal Reserve does not, in fact, provide financial stability.

By law, the Fed has two goals, financial stability and maximum employment. Yet the long look at history says it has not achieved at least the first of these goals.

The late great Milton would agree with the contention of this commentator that the Federal Reserve does not, in fact, provide financial stability.

By law, the Fed has two goals, financial stability and maximum employment. Yet the long look at history says it has not achieved at least the first of these goals.

Thursday, August 27, 2009

The Pros and Cons of ERP Systems

This is one of the best summary accounts I've ever seen on the wisdom and folly of Enterprise Resource Planning (ERP)system implementations. This one is going in my "keep it" file.

Friday, August 21, 2009

Salesforce Rallies

"Salesforce.com rallied in premarket trading on Friday, a day after the company reported second-quarter earnings that beat expectations. The company also raised its full-year outlook. On Friday, FBR upgraded the company to 'market perform' from 'underperform.' Shares gained 9.4 percent to $50.50 before the bell." CNBC Aug 21, 2009.

And the PE Ratio is now 104.5 - down from 106. Well, at least it's moving closer to Oracle's more realistic PE of 20. Only 84.5 points to go!

(Disclaimer - I use Salesforce's CRM system and it's very good software. I just don't understand the stratospheric PE. It's in Dot Bomb territory.)

And the PE Ratio is now 104.5 - down from 106. Well, at least it's moving closer to Oracle's more realistic PE of 20. Only 84.5 points to go!

(Disclaimer - I use Salesforce's CRM system and it's very good software. I just don't understand the stratospheric PE. It's in Dot Bomb territory.)

Friday, August 14, 2009

Recession in 1981-82

I'm starting to sound like a worn-out record (and my kids don't know what that means) but the 81-82 recession was a nasty sucker. If you want to know how nasty, check this out.

Wither Withholding

Since I was old enough to get a paycheck ("Who's this FICA guy and who said he could take my money?") I've been annoyed by the very practice of tax withholding from payroll checks. The very act of it diminishes the visibility of taxes - which is undoubtedly the reason it occurs. I suspect the actual history of the practice is lost in the dark past somewhere. Well, here's a good idea with an even better idea I'm stealing from someone else. Let's double down the thing and move tax collection day from April 15 to the first Monday in November.

Friday, August 7, 2009

Unemployment Today and In Years Gone By

This is today's unemployment numbers after a better-than-expected job loss number. I continue to tell people that 1981-82 unemployment was worse than this recession's but I get little respect for my opinion. I was there and it was. However, people always seem to be stuck in the psychological trap of extrapolating today into both the past and the future.

Tuesday, August 4, 2009

PE Ratio of 106?

My company is implementing a Customer Relationship Management (CRM) system from Salesforce.com. Salesforce is the leading hosted solution - maybe in the world - competing against the likes of Oracle and SAP in this space.

I like the system and investors should know what they invest in so I did a touch of research and found Salesforce.com has a PE ratio of 106. That's 1 ... 0 ... 6. Wow!

I'm going to have to do some serious research here. I haven't heard of a PE ratio like that since the early Amazon days. I wonder if it might be a candidate for short selling?

I like the system and investors should know what they invest in so I did a touch of research and found Salesforce.com has a PE ratio of 106. That's 1 ... 0 ... 6. Wow!

I'm going to have to do some serious research here. I haven't heard of a PE ratio like that since the early Amazon days. I wonder if it might be a candidate for short selling?

Monday, August 3, 2009

Now, to the correction?

S&P500 over 1,000. Nasdaq over 2,000. The Dow at 9286. If you listen to the financial media, they're convinced we're in the start of a boom. When everyone believes one thing then the other must be true. So, does the correction start now?

Tuesday, July 28, 2009

The Law Prevails - Finally

One of the aspects of recent government actions around GM and Chrysler has been the apparent trampling of established bankruptcy laws; particularly the strong-arming of bond holders into accepting less than their legally established returns. It appears that the law has poked its head back up regarding the Delphi bankruptcy. A bankruptcy judge has ruled that the government cannot force Delphi into GM's arms.

Thursday, July 23, 2009

I Think She Did

My last post asked if Meredith Whitney is now assuming the Dr. Doom role and launching a fierce rally with her worst-is-over-for-Goldman comments. The answer appears to be yes. The Dow just broke 9,000 after being up eight of the last nine days. Who was it, Mark Twain, that said history doesn't repeat but it does rhyme? 1982 meet Henry Kaufman. 2009 meet Meredith Whitney.

Tuesday, July 14, 2009

Did She Just Call the Bottom?

Of course she's too late but Meredith Whitney yesterday put a buy recommendation on Goldman Sachs. Is this another Dr. Doom moment? For those of us old enough to remember there was another Dr. Doom before Nuriel Rabini and he was Henry Kaufman, one of the investment sages of the 70s and 80s. During the 1981-82 recession Kaufman (aka Dr. Doom) was relentlessly bearish and pessimistic and the market bobbled up and down with his every utterance. Much the way it does with the imparted wisdom of Meredith Whitney.

Until August 1982 when Kaufman finally admitted that he was wrong - only he didn't say it quite that way. Kaufman's big bugaboo was what he called government crowding out. That is that the government was borrowing so much money to finance deficits that it was crowding private borrowers out of the market. (This manifests in higher interest rates than would otherwise be seen.)

Finally, in the summer of 1982, Kaufman said that the economy was so, so, so bad that load demand was so, so, so weak that the government was no longer crowding out the private sector. And ... wait for it ... the market took off like a rocket; a rocket that went up until the 1991-92 recession.

Yesterday's rally was the Whitney rally - where she admitted she was wrong without admitting she was wrong. (She's still a bear but likes Goldman Sachs a lot.)

Was this a Dr. Doom moment like 1982? It could be. If so, it's a few weeks ahead of my prediction that the spring correction will end in September.

Until August 1982 when Kaufman finally admitted that he was wrong - only he didn't say it quite that way. Kaufman's big bugaboo was what he called government crowding out. That is that the government was borrowing so much money to finance deficits that it was crowding private borrowers out of the market. (This manifests in higher interest rates than would otherwise be seen.)

Finally, in the summer of 1982, Kaufman said that the economy was so, so, so bad that load demand was so, so, so weak that the government was no longer crowding out the private sector. And ... wait for it ... the market took off like a rocket; a rocket that went up until the 1991-92 recession.

Yesterday's rally was the Whitney rally - where she admitted she was wrong without admitting she was wrong. (She's still a bear but likes Goldman Sachs a lot.)

Was this a Dr. Doom moment like 1982? It could be. If so, it's a few weeks ahead of my prediction that the spring correction will end in September.

Thursday, July 9, 2009

The World is Spinning Out of Control

It's rather long and I'm sure I disagree with some of it but still, this is a very interesting, and dire, prediction of the long-term effects of the printing of piles and piles of federal money.

Tuesday, June 30, 2009

Secular Bears - Adjusted

One of my favorite annoyances is that media reports seldom put economic numbers into context. This chart of secular bear markets does just that by adjusting the Standard & Poor's measure by the Consumer Price Index giving a true measure of the market's value.

Thursday, June 18, 2009

Barry Does It Again

Barry Ritholtz of The Big Picture is one of my favorite economics bloggers. Actually, I quite often disagree with his conclusions but he is always thought provoking and well worth the read. This is a fabulous chart of the relative size of ginormous government spending programs. Hold your breath before you enter.

The Book

In a previous life time I was a newspaper reporter. Early in my IT career I published a couple of technical articles on database design (back when relational databases were new technology - check your calendars for that date!). At that time I had ambitions of publishing more articles but then the babies started appearing from some magical place. (I never did understand how that happened ... ) Read more really means read more this time.

Here's an outline for a book I've wanted to write for a long time. By posting this, I'm mostly putting pressure on myself to get cracking on it. The target audience is the professional business manager like a CFO, a VP of Sales, or a Purchasing Director. Quite often these types struggle to understand what motivates people who work with computers. My goal is to give them the keys to their inner geeks. It's supposed to be light hearted but sometimes people don't seem to get it. We'll see how that goes over as I develop the chapters.

Understanding Information Technologies: A Management Guide for the Business Professional

1. Why would a sane person want to work with computers?

a. The psychology of computer people

1. The software developer

2. The technical geek

3. The business analyst

2. What makes a computer person get out of bed in the morning?

a. Falling asleep with dreams of do loops in your head

b. The doofis from accounting down thehall

c. The need for speed

d. He’s really not that into you

3. How can I get them to talk to me in English?

a. You call that English?

b. There really is a thinking human being in there

c. Try donuts, they work

d. Speak English to her and she’ll speak English to you

4. How are computers like narcotics?

a. What two professions call their customers users?

b. Put down the Blackberry and walk away slowly

c. Was it really so bad with manual typewriters?

5. What are the three areas of computing and why should I care? (applications, technical support, and networking)

a. Technical support – don’t look at the man behind the curtain

b. Networking – they make technical support look sexy

c. Applications – almost human

6. What if I don’t have a computer department but I have computers?

a. Finding the inner geek somewhere

b. How to buy hardware when you don’t know what you’re buying

c. How to buy software when you don’t know what you’re buying

d. How to manage the non-IT IT manager

7. I want to install a business system but I don’t know where to start.

a. Are you sure?

b. Are you really sure?

c. The basics of who, what, where, when, why, and how

d. How to find help – you’ll really need it

e. You’re not as smart as you think

f. How can you tell when a salesman is lying?

g. As the song says, Respect Yourself

h. A verbal contract isn’t worth the paper it’s written on

i. A consultant will borrow your watch to tell you the time

j. Do your homework before you go out and play

k. How do you get to Carnegie Hall? Practice, practice, practice.

l. When you throw the switch, do the lights go out?

8. It’s one emergency after another. How can I make it calm down?

a. Your choices in the face of chaos

1. Ignore it

2. Deal with it

3. Manage it

4. Make it go away

b. Learning to manage the noise

c. I have an IT department

1. I need a new manager

2. I need new IT staffers

3. I don’t have an IT department

a. Make one

b. Hiring a great manager

9. How can we make this manageable?

a. The great manager – Part Deux

b. You’re hooked – get used to it

10. How can I know that I’m making the right investment decisions?

a. How do you usually know?

b. Put it in your budget and manage it

c. Count the payback – if you can

11. Finding the right person to run Information Technologies.

a. The great manager – Part Tres

b. Recruiters

c. Help Wanted

d. The IT manager is not a gnome in the basement

e. The IT manager is now part of your management team

12. Making the changes stick so I never have to worry about this again

a. Process change for the scaredy cat

b. Procrastination as an art form

c. Fire quickly and hire slowly

13. Ignoring IT and getting my business done.

a. Bad management can turn gold into dirt

b. Good management can turn dirt into gold

c. Do you ignore sales or purchasing or accounting or production?

d. What are you good at?

e. Getting good at the self-managing IT organization

f. Making it last and feeling good about it

14. Congratulations – relax and enjoy life

Here's an outline for a book I've wanted to write for a long time. By posting this, I'm mostly putting pressure on myself to get cracking on it. The target audience is the professional business manager like a CFO, a VP of Sales, or a Purchasing Director. Quite often these types struggle to understand what motivates people who work with computers. My goal is to give them the keys to their inner geeks. It's supposed to be light hearted but sometimes people don't seem to get it. We'll see how that goes over as I develop the chapters.

Understanding Information Technologies: A Management Guide for the Business Professional

1. Why would a sane person want to work with computers?

a. The psychology of computer people

1. The software developer

2. The technical geek

3. The business analyst

2. What makes a computer person get out of bed in the morning?

a. Falling asleep with dreams of do loops in your head

b. The doofis from accounting down thehall

c. The need for speed

d. He’s really not that into you

3. How can I get them to talk to me in English?

a. You call that English?

b. There really is a thinking human being in there

c. Try donuts, they work

d. Speak English to her and she’ll speak English to you

4. How are computers like narcotics?

a. What two professions call their customers users?

b. Put down the Blackberry and walk away slowly

c. Was it really so bad with manual typewriters?

5. What are the three areas of computing and why should I care? (applications, technical support, and networking)

a. Technical support – don’t look at the man behind the curtain

b. Networking – they make technical support look sexy

c. Applications – almost human

6. What if I don’t have a computer department but I have computers?

a. Finding the inner geek somewhere

b. How to buy hardware when you don’t know what you’re buying

c. How to buy software when you don’t know what you’re buying

d. How to manage the non-IT IT manager

7. I want to install a business system but I don’t know where to start.

a. Are you sure?

b. Are you really sure?

c. The basics of who, what, where, when, why, and how

d. How to find help – you’ll really need it

e. You’re not as smart as you think

f. How can you tell when a salesman is lying?

g. As the song says, Respect Yourself

h. A verbal contract isn’t worth the paper it’s written on

i. A consultant will borrow your watch to tell you the time

j. Do your homework before you go out and play

k. How do you get to Carnegie Hall? Practice, practice, practice.

l. When you throw the switch, do the lights go out?

8. It’s one emergency after another. How can I make it calm down?

a. Your choices in the face of chaos

1. Ignore it

2. Deal with it

3. Manage it

4. Make it go away

b. Learning to manage the noise

c. I have an IT department

1. I need a new manager

2. I need new IT staffers

3. I don’t have an IT department

a. Make one

b. Hiring a great manager

9. How can we make this manageable?

a. The great manager – Part Deux

b. You’re hooked – get used to it

10. How can I know that I’m making the right investment decisions?

a. How do you usually know?

b. Put it in your budget and manage it

c. Count the payback – if you can

11. Finding the right person to run Information Technologies.

a. The great manager – Part Tres

b. Recruiters

c. Help Wanted

d. The IT manager is not a gnome in the basement

e. The IT manager is now part of your management team

12. Making the changes stick so I never have to worry about this again

a. Process change for the scaredy cat

b. Procrastination as an art form

c. Fire quickly and hire slowly

13. Ignoring IT and getting my business done.

a. Bad management can turn gold into dirt

b. Good management can turn dirt into gold

c. Do you ignore sales or purchasing or accounting or production?

d. What are you good at?

e. Getting good at the self-managing IT organization

f. Making it last and feeling good about it

14. Congratulations – relax and enjoy life

Tuesday, June 16, 2009

Why No Picture?

Ever wonder why I don't post a picture on my profile? Here's a snapshot of me from a recent pool party at my summer home and I'm just too modest to show it to just anybody.

Truth be told, I'm still moving into my new (old) house. I have a great picture of me in a bike race from a few years ago. When I find that one, it gets posted.

Truth be told, I'm still moving into my new (old) house. I have a great picture of me in a bike race from a few years ago. When I find that one, it gets posted.

Monday, June 15, 2009

Is This the Corrrection?

As of 10:30 a.m. Central time, the Dow is down just over 200 points. Is this the correction I predicted to start a month ago? Or, perhaps it's a buying opportunity. Actually, it's probably both. A true correction is 20 percent from the peak of 8700 on the Dow, which means it must drop to the 7000 range. I doubt that's going to happen. So far, my market timing has been off but my prediction of the trends has been close. (If you're keeping score.)

Friday, June 12, 2009

The Boats They Be A'Sinking

In years past, I was very respectful of the written word and the well-crafted sentence. As I get older, I gain more appreciation for good images that tell a story. Here's one on the relative size of recent bankruptcies.

Saturday, June 6, 2009

The Geography of Job Loss

Here a great graphic showing the national distribution of job losses. This is similar to one I posted recently regarding housing cost changes around the country.

Someday I'll have to remember that this blog is supposed to be about IT and economics - not a place for my mental diarrhea. Someday ...

Someday I'll have to remember that this blog is supposed to be about IT and economics - not a place for my mental diarrhea. Someday ...

17 Percent Will Boycott GM & Chrysler

I'm sorry I'm on a car kick lately. Again, having grown up in Detroit and working in the auto industry for almost ten years (in the 80s and 90s) I will have a never-ending interest in the industry. GM and Chrysler have destroyed themselves. I didn't have to be so.

Thursday, June 4, 2009

GM & Chrysler are doomed and here's why

It may require a Wall Street Journal subscription but the link will demonstrate quite clearly why GM and Chrysler are doomed. In ten years, Ford, Nissan, Toyota, etc., will rule the roost.

Great Graphic - It's the Bomb!

One of my favorite economics blogs - The Big Picture - has a very good time-phased graphic of the 2008 collapse. Check it out.

Monday, June 1, 2009

Government Motors Explained

I post this only because I grew up in Detroit and I still have family there. Those who didn't grow up there will have a hard time understanding the trauma of GM's bankruptcy. I have no sympathy for either Bush's or Obama's action in this regard, however, this posting is an excellent background piece written by a former Bush official.

The Counterintutivity of Interest Rativity

In this time of financial turmoil (and, come to think of it, doesn't that phrase apply to any time?) pundits will pundize endlessly that for real estate to recover, interest rates must fall. Well, here's a counter-intuitive observation.

I'm old enough to have lived through the Carter years which, at the peak, suffered 18 percent inflation in one quarter of 78 or 79 (I forget which one and I'm too lazy today to look it up.) Rapid price growth has one dramatic affect on buyer behavior; it makes you buy now instead of waiting.

I remember going shopping with my wife when I was a young man with a full head of black hair and buying a rocking chair that we didn't need. Why? Because it would cost a lot more the next time we went out.

This is going to happen to real estate now, I think. Interest rates are going to climb from the 4.875% I just paid for a mortgage a few weeks ago to the 5.2% of today and keep climbing until they reach a natural, un-federal-reservalized number.

Conventional pundit-wisdom (an oxymoron?) says this will put a spike into a nascent real estate recovery. I say the opposite. In anticipation of rising rates, people sitting on the sidelines are going to jump in anticipating future higher rates. Home purchase activity will increase from here ... and the pundits will drop their jaws in amazement.

Again, we'll see just how smart I am ( ... or not).

I'm old enough to have lived through the Carter years which, at the peak, suffered 18 percent inflation in one quarter of 78 or 79 (I forget which one and I'm too lazy today to look it up.) Rapid price growth has one dramatic affect on buyer behavior; it makes you buy now instead of waiting.

I remember going shopping with my wife when I was a young man with a full head of black hair and buying a rocking chair that we didn't need. Why? Because it would cost a lot more the next time we went out.

This is going to happen to real estate now, I think. Interest rates are going to climb from the 4.875% I just paid for a mortgage a few weeks ago to the 5.2% of today and keep climbing until they reach a natural, un-federal-reservalized number.

Conventional pundit-wisdom (an oxymoron?) says this will put a spike into a nascent real estate recovery. I say the opposite. In anticipation of rising rates, people sitting on the sidelines are going to jump in anticipating future higher rates. Home purchase activity will increase from here ... and the pundits will drop their jaws in amazement.

Again, we'll see just how smart I am ( ... or not).

Friday, May 29, 2009

You Say Po-Ta-Toe, I Say Po-Tah-Toe

The Big Picture is one of my favorite sites for economic commentary but this post reflects the po-tay-toe po-tah-toe problem. Barry Ritholtz is an accomplished economist but he has a consistently dour perspective on the markets. I was talking to my financial advisor sister a few days ago and I remarked on a phenomenon I noticed years ago; something that I'm seeing huge quantities of during this recession. One bearish commentator will say how weak our recovery will be and this is a horrible thing. A bullish commentator will say the recovery will be weak and this is a wonderful thing and a great time to get in the market. They look at the same information, come to the same conclusion as to the meaning of the data, and then paint it in the colors of their pre-existing prejudices.

The data is the data. The recovery will be weak. Who doesn't believe that?

The data is the data. The recovery will be weak. Who doesn't believe that?

Wednesday, May 27, 2009

No Wonder I Didn't Get a Bargain

I recently bought a home in Kansas City, Missouri. Several friends from other places in the country asked me if I got it cheap. I said no, as far as I could tell prices were at least stable around here. In fact, I had two houses sold out from under me (I was ready to make an offer when they were sold to someone else).

The chart on the linked title shows why. The real estate collapse is not national; it's regional.

The chart on the linked title shows why. The real estate collapse is not national; it's regional.

Tuesday, May 5, 2009

How Am I Doing - Parte Cuatro

"The markets will slowly improve over the next few weeks, into late April or early May. Then there will be a major pull back that will last until mid-summer. Then in late July or early August, the real market recovery will begin." That was my bold prediction in the third week of March.It is now early May and the market has had a wonderful run for the last few weeks. Some analysts say a bull market has started. Others say it is a suckers bear market rally. Personally, I think the economic recovery has begun but the market is going to pull back in the next few weeks as some traders take some well earned profits. The real bull may start snorting in June instead of July but there should be a pull back here. (Of course, this is a prediction where I'll gladly be wrong.)

Tuesday, April 28, 2009

Posting Will Be Light

I'm busy at work this week and I'm closing on a house, so there's a lot going on. I'll be back next week. (Of course, if I were Instapundit, I could have guest bloggers ... but ... )

Sunday, April 26, 2009

The Great Paul Strassman

Paul Strassman is one of the seminal thinkers on the topic of the economics of IT. The headline link is to his own web site. If you have an interest in this area then you should become acquainted with Mr. Strassman.

Friday, April 24, 2009

The Problem of Personality

I have been working in IT for almost 30 years now and years ago I noticed something that I still can't wrap my puny brain around: Why do most executives display similar personality behaviors?

Let me start by saying that most executives I have worked with have been very able businessmen. (And let me also say that I have worked with many female managers but only male executives. I didn't cause it, it's just the way it has been. If you know of a lady executive (VP or higher) in an industrial company, feel free to add a comment on whether or not my observation holds for women as well.)

Let's call my prototypical executive the Proto-E. In my years I've seen every personality type the human race has to offer at all levels of the business; introverts, extroverts, shy, gregarious, smart, not-so-smart, easy-going, stubborn, you name it. When I get to Proto-Es though the behaviors tend to coalesce around a certain type.

Proto-Es usually have calm personalities. They speak deliberately. They do not often make jokes. They do not often respond to jokes made in their presence. They are almost always pleasant. (In fact, I have seen them behave very pleasantly even when delivering scathing criticisms.)

And they are almost always forceful and direct.

I can only remember one Proto-E I would call indecisive but that was only when he was out of his comfort zone. By training and experience he was an engineer and when speaking of engineering, he was knowledgeable and decisive. When pulled into Accounting or IT or general operations he was much less so. In general, though, he was a good executive because he had a good staff in the areas in which he was weak and this was probably by design.

Another behavior I've noticed is that Proto-Es rarely talk about themselves. Most of us will talk about ourselves until we've bored our companions to tears. The sound of our own voices is sweet, sweet, music to our ears. Proto-Es though; well, it's not so. If I ask a Proto-E how his wife and kids are doing then I'll get a polite response, "fine, thanks". And that's about it.

Now here's my question. Where is the cause-and-effect here? From time-to-time I've had illusions that I could aspire to executive-hood. I believe I still can but only if I owned my own business. I do not believe that I can as long as I'm employed by someone else in a corporate environment. No board of directors is going to accept my quirks, my dry sense of humor. And I'm in no mood to change them. I like my quirks.

But do Proto-Es become executives because they have Proto-E personalities or do they adapt and adopt Proto-E personalities as they move up the corporate ladder? The only way I could personally know is to know a Proto-E who moved up the food chain from the time he or she was only a gleam in the board of directors eyes. I've never known one that long.

So, having rambled too long on this for the moment, I'll come back to the question later. Why do Proto-Es dominate the executive suite?

Let me start by saying that most executives I have worked with have been very able businessmen. (And let me also say that I have worked with many female managers but only male executives. I didn't cause it, it's just the way it has been. If you know of a lady executive (VP or higher) in an industrial company, feel free to add a comment on whether or not my observation holds for women as well.)

Let's call my prototypical executive the Proto-E. In my years I've seen every personality type the human race has to offer at all levels of the business; introverts, extroverts, shy, gregarious, smart, not-so-smart, easy-going, stubborn, you name it. When I get to Proto-Es though the behaviors tend to coalesce around a certain type.

Proto-Es usually have calm personalities. They speak deliberately. They do not often make jokes. They do not often respond to jokes made in their presence. They are almost always pleasant. (In fact, I have seen them behave very pleasantly even when delivering scathing criticisms.)

And they are almost always forceful and direct.

I can only remember one Proto-E I would call indecisive but that was only when he was out of his comfort zone. By training and experience he was an engineer and when speaking of engineering, he was knowledgeable and decisive. When pulled into Accounting or IT or general operations he was much less so. In general, though, he was a good executive because he had a good staff in the areas in which he was weak and this was probably by design.

Another behavior I've noticed is that Proto-Es rarely talk about themselves. Most of us will talk about ourselves until we've bored our companions to tears. The sound of our own voices is sweet, sweet, music to our ears. Proto-Es though; well, it's not so. If I ask a Proto-E how his wife and kids are doing then I'll get a polite response, "fine, thanks". And that's about it.

Now here's my question. Where is the cause-and-effect here? From time-to-time I've had illusions that I could aspire to executive-hood. I believe I still can but only if I owned my own business. I do not believe that I can as long as I'm employed by someone else in a corporate environment. No board of directors is going to accept my quirks, my dry sense of humor. And I'm in no mood to change them. I like my quirks.

But do Proto-Es become executives because they have Proto-E personalities or do they adapt and adopt Proto-E personalities as they move up the corporate ladder? The only way I could personally know is to know a Proto-E who moved up the food chain from the time he or she was only a gleam in the board of directors eyes. I've never known one that long.

So, having rambled too long on this for the moment, I'll come back to the question later. Why do Proto-Es dominate the executive suite?

Saturday, April 18, 2009

The Slow, Painful Demise of Strategic IT - Numero Dos

This posting on CIO is well worth a quick follow-up posting. Christopher Koch makes a substantive argument that CIOs should always report to CEOs and that when they don't, it is a dysfunctional relationship that damages the organization. I've worked both ways and I'm not convinced either way but Koch makes a powerful argument. Read the whole thing.

The Slow, Painful Demise of Strategic IT

Does IT reporting to the CFO or CEO actually make a difference? The iconic Jack Welsh thinks so. The article on the CIO website is a couple of years old but the topic is still valid. Keep reading through the comments to get some interesting aspects to the question.

Thursday, April 9, 2009

The Interviews So Far

Next up is an interview with an accomplished senior IT executive and his view of the state of Information Technologies. In the meantime, please take another look at the perspectives of a career counselor and a corporate recruiter.

Investing in the IT Staff - with Gino Macarroni

http://capcom-it.blogspot.com/2009/03/investing-in-information-technologies_07.html

So You Think You Know What a Recruiter Thinks? - with Diane Plymale

http://capcom-it.blogspot.com/2009/04/so-you-think-you-know-what-recruiters.html

Investing in the IT Staff - with Gino Macarroni

http://capcom-it.blogspot.com/2009/03/investing-in-information-technologies_07.html

So You Think You Know What a Recruiter Thinks? - with Diane Plymale

http://capcom-it.blogspot.com/2009/04/so-you-think-you-know-what-recruiters.html

The Problem of Personality - Watch This Space

Here's something that's bothered me for years - decades even. In almost every corporate organization I've worked in, the senior executives seem to have all of their natural-born personalities smushed out of them in the climb up the ladder. I've been pondering this lately and I'll have some thoughts on that soon. If you're breathless in anticipation you may want to check back in a day or two.

Tuesday, April 7, 2009

I'll Have Another Round

Here's a great segment from CNBC with Mario Gabelli. I find him easy to like and I flatter myself to think that we share a similar sense of humor. If you're at all interested in finance and investing you should check it out. I would buy his drinks all night just to hear him opine.

Monday, April 6, 2009

The Charge Back Myth

Here is one my all time favorite misapplications of time for an IT department - charge backs.I've worked in a larger than 100 person IT staff that used a charge back mechanism to apportion cost. What was the result? User departments dickered over each megabyte of disk space and CPU MIP (meaningless indicator of processing speed).

Did this method actually contribute anything to the growth and profitability of the company? Not that I could tell. Instead, the users rationed their own use of IT and self-constrained themselves into treating IT as a public utility and not a business partner.

Or let me ask it this way, is Human Resources a partner in the business? Every executive I've ever met said absolutely, yes. Human Resources is how you recruit and retain the best and brightest. Yet, show me one HR department that uses a departmental charge back method to pay for itself. I've never even heard it discussed, much less implemented.

When companies use charge back methods for IT then the arguments are over funny money. No actual cash will be involved but department managers will argue with great passion as if real money was leaving their checking accounts.

Now, treating IT as a profit center is something I'd consider - even though that has it's own problem. At least with the profit center model, IT itself sets a going rate for its services. With the profit center model, though, IT must be compelled to compete with outside services and earn its profit.

Either way, the author's idea is one of the oldest and, in my mind, least productive IT governance methods out there.

Did this method actually contribute anything to the growth and profitability of the company? Not that I could tell. Instead, the users rationed their own use of IT and self-constrained themselves into treating IT as a public utility and not a business partner.

Or let me ask it this way, is Human Resources a partner in the business? Every executive I've ever met said absolutely, yes. Human Resources is how you recruit and retain the best and brightest. Yet, show me one HR department that uses a departmental charge back method to pay for itself. I've never even heard it discussed, much less implemented.

When companies use charge back methods for IT then the arguments are over funny money. No actual cash will be involved but department managers will argue with great passion as if real money was leaving their checking accounts.

Now, treating IT as a profit center is something I'd consider - even though that has it's own problem. At least with the profit center model, IT itself sets a going rate for its services. With the profit center model, though, IT must be compelled to compete with outside services and earn its profit.

Either way, the author's idea is one of the oldest and, in my mind, least productive IT governance methods out there.

Sunday, April 5, 2009

Tell me what you like

Sometimes I wonder about the purpose of a blog. Is it a simple exercise in narcissism where a person (me in this case) bloviates on topics great and small? Maybe its a tool to serve a greater social purpose of communication. This would be a societal version of Adam Smith's invisible hand. (If you're not familiar with Adam and the invisible hand, then please look it up in Wikipedia. It will be well worth your time and may change your outlook on life.)

But my question is what do you want to see here? My essential topic is capital investment and information technologies in the corporate world. I also admit that I often wander into current finance and economics topics.

I ask that you keep topics suggestions to these general areas but I'd like to know what you find interesting. It would be easy for me to be a lone voice in the wilderness but I will serve you better if we have not a monologue but a discussion.

Let me know what you think with your comments.

But my question is what do you want to see here? My essential topic is capital investment and information technologies in the corporate world. I also admit that I often wander into current finance and economics topics.

I ask that you keep topics suggestions to these general areas but I'd like to know what you find interesting. It would be easy for me to be a lone voice in the wilderness but I will serve you better if we have not a monologue but a discussion.

Let me know what you think with your comments.

Wednesday, April 1, 2009

So you think you know what recruiters think?

Diane Plymale is an experienced marketer working for Convergence LLC and she has some interesting things to say about Information Technologies, careers, and how recruiters work. Take a peak at my recent interview with Diane and then check out the Convergence web site at www.conv.com. (Come on, I know you want to look.)

--------------------------------------------------------------------------------------

Q. Diane, can you tell us a little bit about yourself and how you came to be a corporate recruiter?

A. I’m not actually a recruiter. I’m more in the corporate business development and our recruiters work for me. My former career was in medical administration in Florida and I helped put together group practices. I did everything in medical management from A to Z including human resources.

I came into this role after I attended a job fair. I hadn’t really thought of working for staffing companies but out of curiosity I stopped by one at the fair and I learned that in addition to recruiters they needed help with marketing and management. They asked me to join them in a business development role. This company worked in placements for everything but IT.

I was there almost two years and through them I networked with the branch manager here at Convergenz in Kansas City and also I met two of the company owners. They recruited me to come work at Convergence which works in primarily Information Technologies and technology related positions. Other areas like accounting and marketing comprise approximately about 20 percent of the business.

Q. How did you come to specialize in placements for information technologies professionals?

A. I was married to someone who worked for a major communications company for a lot of years and that (marriage) gave me a ten thousand foot view of information technologies. This was the basis for my exposure to IT and in my current role I’ve become more and more specialized.

Q. What are the differences between IT professionals and those in other trades like accounting or engineering? By this I mean differences in attitude, behaviors, communication skills, and their approaches into business?

A. I would say I group engineering and IT together; they’re similar types of people. In each of these fields, their attitudes and behaviors are highly individual. For the most part in IT and engineering (I’m not as well versed in accounting) we look for a very specialized skill sets and each individual makes up a different cog of the entire machine.

The personalities are different than in other professions. An engineer or computer person is in a much less collaborative position than a situation like marketing where you have to work in groups and teams. In a typical situation, when you are a Java developer, someone else has already figured out the game plan, the developer creates what needs to be done to fit that outline or end goal, and then the next person in the sequence carries out the next step and so on. It’s a much a more segmented environment than in other areas which are more collaborative.

By this I don’t mean that engineers and IT people don’t collaborate – they do – but they have an almost union-like attitude that Guy A does this and Guy B does that. This view mainly applies to large IT organizations. As IT organizations grow, they demand a broader and much more specialized talent pool. Also, the way technology is birthed, developed, and is completed demands stages & different skill sets & abilities for each stage; for example the lifecycle of development i.e. planning, analysis, design, implementation, etc.

A smaller company with a small IT group is much less specialized. A mid-sized or smaller company requires a different skill set than a large company. If you’re working in a company of 20 people, you have to be happy to do the filing and take out the trash. The basic IT skills would be similar but a job description from a smaller company will have a more varied set of requirements, not just one specialized technical skill set but a more varied range of skill sets.

Q. Would you say that ITers have a better or worse understanding of business than professionals in other areas?

A. I think for the most part they have a worse overall understanding than perhaps someone in marketing or business development. The IT person may have a better understanding of the technical aspects of a business from working with things like computer systems that hold a general ledger but they, in general, have a poorer understanding of what is “driving” the overall business in general. Unless, it is a technology driven type company, which in that case, the IT people are the drivers behind the business.

The last thing that some business people think of is the details behind the business. For example, how when you implement an electronic medical record system, how are records going to be stored, who manages that data, speed of retrieval, etc? The IT department understands that but also, a lot of times, has to convince the CFO to give them the dollars on their side of the house.

Q. Rate the nerd factor of the following careers from least to most nerdy: information technologies, accounting, engineering, sales,

A. Least nerdy will be sales, then engineering, then accounting, and information technologies will be the most nerdy.

(Editor: One of my favorite comments was from an accountant who told me that she likes computer people because they make accountants look sexy.)

Q. You work with a lot of executives who are recruiting mid and senior-level managers. Is there any consistent thing you see from engagement to engagement? Or to ask it another way, do you see any consistent traits in candidates that executives are always seeking?

A. For the most part, executives are looking for recruits who have an understanding of business and where a business (their business) should be going and/or is going. They want more of an overall view as opposed to a narrow, microscopic view and this is especially true in mid-sized and smaller companies. In larger companies, the IT professional needs to have at least an overall sense of how a business works & what drives business.

Q. I’ve met executives who treat recruiting as slots to be filled and I’ve worked with those who treat each opening as an opportunity to invest in the future of the organization by doing what it takes to find the best possible person for a position. In your opinion, which type is more common, the slot-filler or the gardener?

A. I don’t know if I’ve just been lucky but for the most part it has been very important for the individuals I’ve worked with to get the right person and definitely are not out to just find a body to fill a slot. For instance, I’m dealing with a major railroad and they are so, so concerned with people fitting into the company culture. I’ve seen that across the board in small, large, and medium sized organization. Generally I support IT managers and directors and this is the way a large majority feel.

Q. Do you enjoy managing recruiting?

I love this entire profession of managing, recruiting, and placement. Sometimes it makes you pull your hair out because you’re dealing with people. However, it’s also very satisfying because you are critical to placing key people who can make a huge, positive impact in their businesses.

Q. Why?

A. In addition to what I just said it’s that it’s always different - technology is always changing. Whatever skill sets our candidates need now, will change in a few years. It’s always different.

Q. How quickly can you disqualify an inferior candidate?

A. Pre-Hire: I can disqualify a candidate in seconds who doesn’t meet the top line requirements. There are always requirements a client has to have and if the candidate doesn’t have them, we can mark him or her off the list quickly.

Post-Hire: Once in a while you don’t discover there is an issue until they’ve actually been working for a while. Some candidates interview well but turn out not to have the skills or don’t fit the culture. When we place someone like that you don’t know it until after he or she gets on the job and a month later we start getting phone calls.

Q. Is it difficult to work with some candidates?

A. No, not very often. Actually the most common sticking point is money. The candidate will tell us that everything is fine but after getting an interview and/or an offer, he or she will come back and ask for more money. Some are difficult to work with on simple things like filling out paperwork – getting background info for us, going to get their drug screens completed, etc. Then some have odd quirks but that’s just part of the business you come to expect.

We can’t walk in every candidate and introduce them to the manager but the pre-interview advice the recruiters give to most candidates is to behave professionally, wear a suit, etc. Once we had a guy show up in a suit from the 1970s. After that we clarified that we mean a suit you’ve purchased in the last five years.

Q. Who is harder to work with, an arrogant candidate or a shy candidate?

A. They’re pretty much even – there are different challenges with each. Arrogant candidates are confident but they can talk themselves out of a job. A shy candidate would be fine in a developer role by him or herself but for a position that interfaces with the customer then we probably wouldn’t even submit them for a position like that. It just depends on the situation.

Some hiring companies won’t even look at a shy person; communication skills come up all the time. We have a senior position with a major railroad and they’ve been looking for “right” person for over a year. We sent them three candidates and we had one guy in the final interview who looked good but the client told us that he wasn’t arrogant enough to do the job. They want someone who can ramrod through a plan. “I need a czar to come into this position.”

In another situation, we had one guythat did the first two of three interviews well. On the third interview he didn’t wear a suit and walked in like he already had the whole thing in the bag. But that wasn’t the case and he lost an offer that he almost certainly had because of his arrogance.

Q. You’ve been doing this for a few years, I think long enough to have seen some trends develop. Have you seen any changes in the attitudes and approaches of executives who are trying to fill a position?

A. A lot of the trends that people know universally are around dress codes – it’s more relaxed for some positions like a developer. In the prior days you would have dressed for every type of position. You definitely had to be careful about hair, tattoos, and those kinds of things. Nowadays it’s more about the position and the person than what the person looks like.

Executives are more concerned about culture now and they’re definitely starting to get it. Yet a lot of them still don’t get it. They don’t understand what new generation is like and their “quirks” and how to accommodate these things to make them work better and be more productive. There are a lot of attitude changes yet to come but managers are starting to catch on.

Managers also need to consider not just the generational change but also the changes in technology and industry trends. Most skills sets for a lot of positions a great deal between companies but technology roles like developers do change. The managers also need to take into account that they can’t be arrogant about a search and they can’t just walk out and find the perfect person.

Even in a recession that’s true. It’s still a tough job to find the right person. Entry- level positions are easier to fill but for mid-level and higher positions it is still difficult to find the right fit for a position.

Q. Now let’s look at it from the other side. Have you noticed any trends in the attitudes and approaches of candidates?

Q. I get shocked every day. You hear every single day about how bad the economy is but when you call people who have not had jobs for months and offer them a year-long contracting position, they will not even listen to the offer. That type of attitude is wrong. The contract-to-hire position is the way you’re going to get into a lot of companies. I think it’s a lack of knowledge and education about the staffing/consulting industry on the part of the candidates and hey don’t understand this is another very viable way of finding the right type of job or at the very least an entry point into a really great company, especially in times like this.

Today this may be the only option. A few years ago there were tons of jobs - send in a resume and you’ll get in - but now there’s a fifty-fifty chance that you’ll have work for a contracting company to end up with a permanent position.

I’m working on a panel for The Central Exchange (a professional organization for women and career management at www.centralexchange.org) and they invited me to be part of a forum to speak about this trend. I’m telling them that this is not like working for Kelly’s Temps or that kind of thing. This is a complete other area of the business community. You need to go to contracting companies and get your name in with every single one of them.

All of these contracting companies have organizations for which they recruit and you (as a candidate) need to spread out into these organizations. I think people don’t understand that. People who have been in one position for 20 years are simply not aware of this.

Q. Would improving her or his knowledge of business improve an IT professional’s chance of success?

A. Absolutely. Let me give you an example. People who come out of an organization like (a major communications company) know everything there is to know about telecommunications but they have no clue about other businesses in their community or have kept track of the “current” trends of businesses and industries. Whatever the position you’re seeking, you need to understand the entire business, how it’s positioned, and where it’s going. If you do this in IT you’re better able to sell yourself because you have a better understanding of how IT contributes to a business.

Q. How would you recommend an IT professional go about gaining business experience outside of IT?

A. First of all, be aware of market trends. For instance, right now energy businesses are a big deal and that’s a trend. My advice is to try to keep up on those kinds of things and stay on top of what’s going on.

A lot of IT professionals get embedded and aren’t aware, in a “big picture” kind of way, of where things are going. You get a certain position where you’re useful but then a major system change goes in place and suddenly the only reason you’re there is to manage a legacy system. This system eventually won’t be there and you just missed the boat. You always need to look at the next career upgrade, particularly in the technology areas.

Now certain people shine more than others. A company where a woman I know works, have already begun to identify “key” people in the organization and is working to fast-track them to replace the baby boomers. A company should have a solid program to move its people who are excelling within the organization along its food chain. If that’s not there then it generally takes a new set of leadership to wake up the others to this need.

Q. Do you think executives treat your candidates as investments or expenses?

A. With accountants they tend to focus on salary and compensation. Other areas tend to focus on candidates as investments and try harder to hire the right people. If it’s a technology driven company, they’ll pay what they must. But a hospital, for instance, that’s just not where this philosophy exists. Manufacturing is another area where you see the focus on cost and not on investment.

Q. How can executives become better recruiters?

A. When you need legal help you hire a lawyer. When you need financial help you hire an accountant. You need to use recruiting and contracting companies for providing top talent. Make a relationship with a recruiting/staffing company you can trust and set up metrics to grade them to make sure they’re doing the job for you. Then the executive doesn’t need to worry about how to get the right person, that’s the recruiter’s job.

Q. How can professionals become better candidates?

A. Use everything you can to gain an edge. Yesterday, I was visiting Payless and a manager wanted to help his son – the son was talking about interviewing – so the manager sought my advice for his son. This is one way his son will get an edge.

One very basic thing is to understand even in our changing times, with changing attitudes about appearance, is that neatness still counts. With two equivalent candidates the better dressed/groomed person will get the job because of the impression he or she makes. The new generation doesn’t think that this matters but it does. Little things like that can make the difference.

For professionals, my advice is to work on the diversity of your background and avoid getting pigeonholed into one skill set. You might consider volunteer work to get a better understanding your community or maybe do technology work with charity organizations. Do something other than your day-to-day job. Even though a company will hire for a specific job they also will be looking for exposure to other areas that show that a candidate has a diverse skill set.

Q. Diane, thank you for your time and your advice.

A. You’re welcome and thank you.

Diane Plymale can be reached in the Convergence Kansas City office at 913.338.1800 or through www.conv.com.

--------------------------------------------------------------------------------------

Q. Diane, can you tell us a little bit about yourself and how you came to be a corporate recruiter?

A. I’m not actually a recruiter. I’m more in the corporate business development and our recruiters work for me. My former career was in medical administration in Florida and I helped put together group practices. I did everything in medical management from A to Z including human resources.

I came into this role after I attended a job fair. I hadn’t really thought of working for staffing companies but out of curiosity I stopped by one at the fair and I learned that in addition to recruiters they needed help with marketing and management. They asked me to join them in a business development role. This company worked in placements for everything but IT.

I was there almost two years and through them I networked with the branch manager here at Convergenz in Kansas City and also I met two of the company owners. They recruited me to come work at Convergence which works in primarily Information Technologies and technology related positions. Other areas like accounting and marketing comprise approximately about 20 percent of the business.

Q. How did you come to specialize in placements for information technologies professionals?

A. I was married to someone who worked for a major communications company for a lot of years and that (marriage) gave me a ten thousand foot view of information technologies. This was the basis for my exposure to IT and in my current role I’ve become more and more specialized.

Q. What are the differences between IT professionals and those in other trades like accounting or engineering? By this I mean differences in attitude, behaviors, communication skills, and their approaches into business?

A. I would say I group engineering and IT together; they’re similar types of people. In each of these fields, their attitudes and behaviors are highly individual. For the most part in IT and engineering (I’m not as well versed in accounting) we look for a very specialized skill sets and each individual makes up a different cog of the entire machine.

The personalities are different than in other professions. An engineer or computer person is in a much less collaborative position than a situation like marketing where you have to work in groups and teams. In a typical situation, when you are a Java developer, someone else has already figured out the game plan, the developer creates what needs to be done to fit that outline or end goal, and then the next person in the sequence carries out the next step and so on. It’s a much a more segmented environment than in other areas which are more collaborative.

By this I don’t mean that engineers and IT people don’t collaborate – they do – but they have an almost union-like attitude that Guy A does this and Guy B does that. This view mainly applies to large IT organizations. As IT organizations grow, they demand a broader and much more specialized talent pool. Also, the way technology is birthed, developed, and is completed demands stages & different skill sets & abilities for each stage; for example the lifecycle of development i.e. planning, analysis, design, implementation, etc.

A smaller company with a small IT group is much less specialized. A mid-sized or smaller company requires a different skill set than a large company. If you’re working in a company of 20 people, you have to be happy to do the filing and take out the trash. The basic IT skills would be similar but a job description from a smaller company will have a more varied set of requirements, not just one specialized technical skill set but a more varied range of skill sets.

Q. Would you say that ITers have a better or worse understanding of business than professionals in other areas?

A. I think for the most part they have a worse overall understanding than perhaps someone in marketing or business development. The IT person may have a better understanding of the technical aspects of a business from working with things like computer systems that hold a general ledger but they, in general, have a poorer understanding of what is “driving” the overall business in general. Unless, it is a technology driven type company, which in that case, the IT people are the drivers behind the business.

The last thing that some business people think of is the details behind the business. For example, how when you implement an electronic medical record system, how are records going to be stored, who manages that data, speed of retrieval, etc? The IT department understands that but also, a lot of times, has to convince the CFO to give them the dollars on their side of the house.

Q. Rate the nerd factor of the following careers from least to most nerdy: information technologies, accounting, engineering, sales,

A. Least nerdy will be sales, then engineering, then accounting, and information technologies will be the most nerdy.

(Editor: One of my favorite comments was from an accountant who told me that she likes computer people because they make accountants look sexy.)

Q. You work with a lot of executives who are recruiting mid and senior-level managers. Is there any consistent thing you see from engagement to engagement? Or to ask it another way, do you see any consistent traits in candidates that executives are always seeking?

A. For the most part, executives are looking for recruits who have an understanding of business and where a business (their business) should be going and/or is going. They want more of an overall view as opposed to a narrow, microscopic view and this is especially true in mid-sized and smaller companies. In larger companies, the IT professional needs to have at least an overall sense of how a business works & what drives business.

Q. I’ve met executives who treat recruiting as slots to be filled and I’ve worked with those who treat each opening as an opportunity to invest in the future of the organization by doing what it takes to find the best possible person for a position. In your opinion, which type is more common, the slot-filler or the gardener?

A. I don’t know if I’ve just been lucky but for the most part it has been very important for the individuals I’ve worked with to get the right person and definitely are not out to just find a body to fill a slot. For instance, I’m dealing with a major railroad and they are so, so concerned with people fitting into the company culture. I’ve seen that across the board in small, large, and medium sized organization. Generally I support IT managers and directors and this is the way a large majority feel.

Q. Do you enjoy managing recruiting?

I love this entire profession of managing, recruiting, and placement. Sometimes it makes you pull your hair out because you’re dealing with people. However, it’s also very satisfying because you are critical to placing key people who can make a huge, positive impact in their businesses.

Q. Why?

A. In addition to what I just said it’s that it’s always different - technology is always changing. Whatever skill sets our candidates need now, will change in a few years. It’s always different.

Q. How quickly can you disqualify an inferior candidate?

A. Pre-Hire: I can disqualify a candidate in seconds who doesn’t meet the top line requirements. There are always requirements a client has to have and if the candidate doesn’t have them, we can mark him or her off the list quickly.

Post-Hire: Once in a while you don’t discover there is an issue until they’ve actually been working for a while. Some candidates interview well but turn out not to have the skills or don’t fit the culture. When we place someone like that you don’t know it until after he or she gets on the job and a month later we start getting phone calls.

Q. Is it difficult to work with some candidates?

A. No, not very often. Actually the most common sticking point is money. The candidate will tell us that everything is fine but after getting an interview and/or an offer, he or she will come back and ask for more money. Some are difficult to work with on simple things like filling out paperwork – getting background info for us, going to get their drug screens completed, etc. Then some have odd quirks but that’s just part of the business you come to expect.

We can’t walk in every candidate and introduce them to the manager but the pre-interview advice the recruiters give to most candidates is to behave professionally, wear a suit, etc. Once we had a guy show up in a suit from the 1970s. After that we clarified that we mean a suit you’ve purchased in the last five years.

Q. Who is harder to work with, an arrogant candidate or a shy candidate?

A. They’re pretty much even – there are different challenges with each. Arrogant candidates are confident but they can talk themselves out of a job. A shy candidate would be fine in a developer role by him or herself but for a position that interfaces with the customer then we probably wouldn’t even submit them for a position like that. It just depends on the situation.