Wednesday, September 30, 2009

Monday, September 28, 2009

Will the Stimulus Create Jobs?

According to an article by Veronique de Rugy and Garett Jones, not only will it not create jobs, it cannot create jobs.

Monday, September 21, 2009

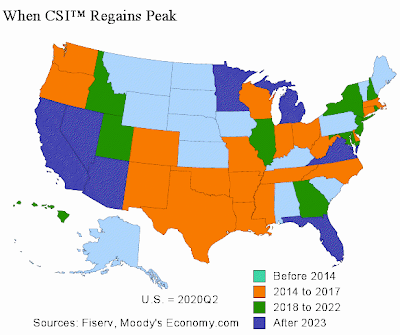

The Real Estate Recovery

Here is a very interesting graphic predicting the timing of the recovery of real estate values. I remember the decline of the late 1980s and early 90s clearly - when then Savings and Loan debacle occurred. The decline that began in 2006 looks like it will dwarf the S&L-induced decline. In the case of the S&L decline, real estate had regained its highs by the late 90s. It may be decades before some parts of the country recover this time around.

Sunday, September 20, 2009

A Lament for My Children

A few months ago, my company had a retirement consultant give a lunch-time presentation on 401k accounts. He was very knowledgable and well spoken so it was a worthwhile discussion. At one point he was discussing national fiscal habits and asked the group "who do you think will be paying for the deficits and the stimulus package?" Unprompted, I answered, "My children." This cartoon from the Wall Street Journal says it better than I can.

Thursday, September 17, 2009

Right on Time

I'll repeat an observation I made earlier that the market rebound in March of 2009 would signal economic growth six months later. Now it's September and here it is - in a fashion that no one can deny. Now the debate will be V-Shape, W-Shaped, or L-Shaped recovery.

Tuesday, September 15, 2009

Not What They Had In Mind

Want to know more about the effects of unintended consequences? Read this.

Thursday, September 10, 2009

Why is ERP Still So Hard?

Because you're changing the wings of the plane while it's still in the air. Check this out for a good discussion on the topic.

The key information I gleaned is this: the average SAP implementation costs $17 million, Oracle ERP is $12 million, Microsoft Dynamics is $2.6 million and other (Tier 2) systems like JD Edwards or ERP LN come in around $3.5 million.

I'm betting a lot of SAP and Oracle ERP customers wonder what they get for their premium.

The key information I gleaned is this: the average SAP implementation costs $17 million, Oracle ERP is $12 million, Microsoft Dynamics is $2.6 million and other (Tier 2) systems like JD Edwards or ERP LN come in around $3.5 million.

I'm betting a lot of SAP and Oracle ERP customers wonder what they get for their premium.

Wednesday, September 2, 2009

Goverment Spending Cannot Create Jobs

I've long believe that John Maynard Keynes was wrong and that government spending during an economic downturn has no net effect on economic performance. I studied Keynes in graduate school. I could regurgitate his ideas well enough to get a passing grade but they never really made sense to me. This link has a good (non technical) explanation why.

The money quote, "Keynesian economists counter that redistribution can increase demand if the money is transferred from savers to spenders. Yet this “idle savings” theory assumes that savings fall out of the economy, which clearly is not the case. Nearly all individuals and businesses invest their savings or put it in banks (which in turn invest it or lend it out) — so the money is still being spent somewhere in the economy. Even in this recession, with tightened lending standards, banks are performing their traditional role of intermediating between those who have savings and those who need to borrow. They are not building extensive basement vaults to hoard cash."

The money quote, "Keynesian economists counter that redistribution can increase demand if the money is transferred from savers to spenders. Yet this “idle savings” theory assumes that savings fall out of the economy, which clearly is not the case. Nearly all individuals and businesses invest their savings or put it in banks (which in turn invest it or lend it out) — so the money is still being spent somewhere in the economy. Even in this recession, with tightened lending standards, banks are performing their traditional role of intermediating between those who have savings and those who need to borrow. They are not building extensive basement vaults to hoard cash."

Tuesday, September 1, 2009

A September Marker

Conventional wisdom says that the stock market leads the economy, usually by about six months. In March of 2009, the Dow hit what I hope is the bottom for the year. The very good performance since then, and the six month lag of the real economy, means the economy should start performing measurably better ... right ... about ... now!

Subscribe to:

Posts (Atom)

Woke Terror

I recently heard a new phrase that stuck in my head like a dart in a dart board - Woke Terror . In our world a formerly innocent remark...

-

Almost everybody in the IT business is familar with Gartner and Magic Quadrants. Here's another useful visua l from Thomas Wailgum at CI...

-

Crowing out was a term I became familiar with in the 80-81 recession where Paul Volcker saved the future. The tenet is that government spend...

-

I recently heard a new phrase that stuck in my head like a dart in a dart board - Woke Terror . In our world a formerly innocent remark...